Why the Risk of a U.S. Recession Is Rising Right Now

Key Points

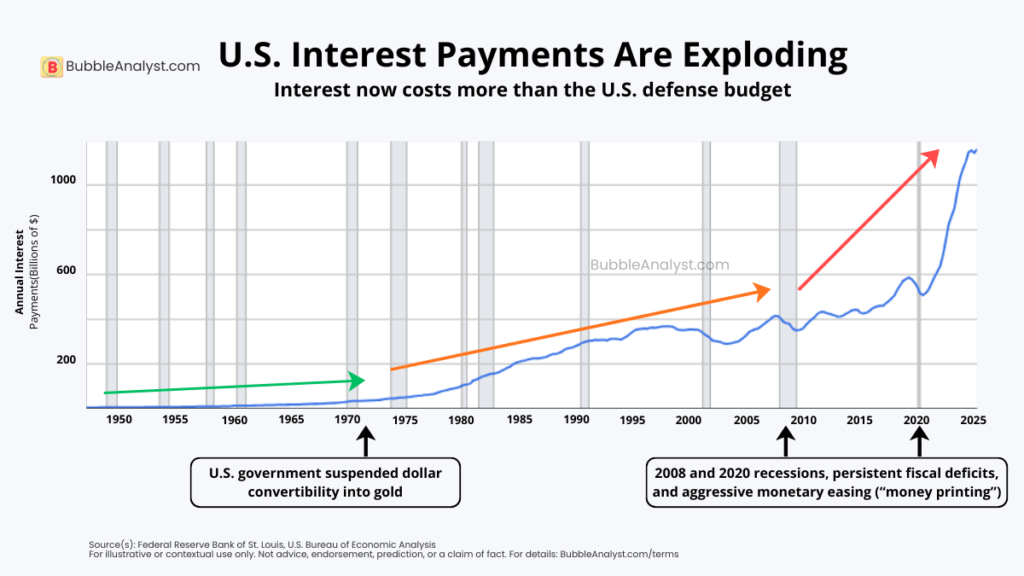

- With U.S. debt well above GDP levels last seen during World War II—and interest costs now rivaling defense spending—borrowing is no longer supporting economic growth; it has become a structural drag that could cause US recession in 2026.

- Jobs are disappearing ‘permanently’, housing starts are falling.

- An AI capex bubble, a potential Bitcoin shock, and prolonged global conflicts mean one trigger could tip the system into a 2026 recession.

The Debt Crisis

If a recession were to hit in 2026, one of the most likely culprits would be America’s spiraling national debt. The U.S. debt has now crossed $38 trillion, exceeding 125% of GDP — one of the highest ratios in modern American history. And here’s the part many people miss: the interest payments alone are now larger than the entire U.S. defense budget — and remember, the U.S. military is the most expensive in the world. When interest becomes your biggest bill, we have to ask ourselves a difficult question: is a US recession in 2026 becoming unavoidable as debt, interest costs, and systemic risks collide?

The alarming part that increases the US recession risk in 2026 is that the debt is growing unabated. Every second, roughly $69,000 is added to the national ledger, according to the Joint Economic Committee. That’s more than a typical American’s annual income — added EVERY SINGLE SECOND. This means recession pressure is baked into the system: as debt grows faster than the economy, the government is forced to spend more on yesterday’s borrowing instead of tomorrow’s investment. A potential US debt reset could reshape monetary policy, asset prices, and the trajectory of the next US recession – but it might affect overall growth, nevertheless.

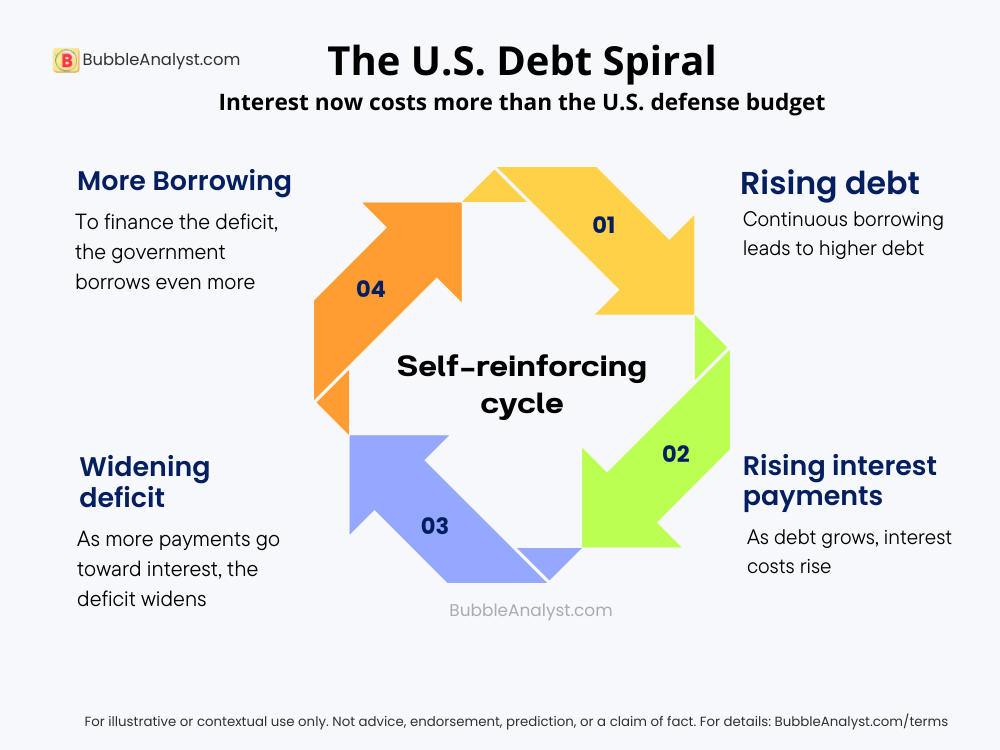

If growth slows — which many analysts expect in 2026 — tax revenues fall, borrowing spikes further, and interest costs accelerate. This creates a self-reinforcing downward cycle that could act as a precursor to a US economic recession in 2026:

- Higher debt → higher interest payments

- Higher interest → bigger deficits

- Bigger deficits → more borrowing

- More borrowing → weaker confidence and slower growth

In such a scenario, debt becomes not just a number but a drag on the real economy. Businesses pull back, consumers lose confidence, markets turn volatile — and suddenly, a US Recession in 2026 is no longer a warning… it’s a logical outcome.

AI bubble

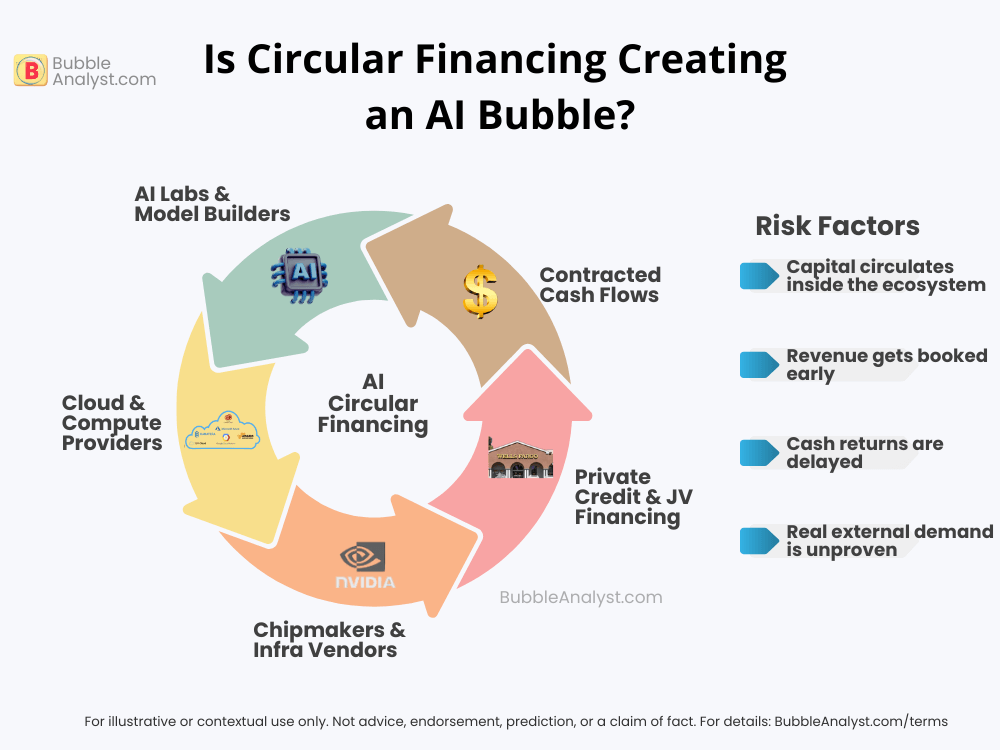

One of the least discussed US recession risks for 2026 is the AI investment bubble quietly forming inside America’s largest tech companies. On the surface, AI appears to be a productivity revolution. Underneath, its financial structure increasingly resembles the late-1990s dot-com bubble—only far larger, more leveraged, and embedded directly in the balance sheets of trillion-dollar firms that anchor U.S. markets. In this environment, a US recession in 2026 would not be triggered by a single shock, but by multiple overstretched systems failing together.

Over the past two years, Meta, Amazon, Alphabet, Microsoft, and Nvidia have launched a once-in-history capital-spending surge. Estimates suggest $300–$400 billion in AI-related capex for 2025 alone, with as much as 90–95% of operating cash flows being reinvested into GPUs, data centers, and cloud infrastructure. Unlike the dot-com era—when small startups failed in isolation—today’s risk sits inside the world’s most systemically important companies. A major red flag is the rise of “circular AI financing”.

Companies rent cloud capacity to one another, sign billion-dollar “compute deals” that recycle capital back into AI, and increasingly rely on private credit to fund massive data centers. History suggests that when expected payoffs are delayed, these structures are often the first to collapse—much like telecom overbuilds after 2001.

If the AI boom continues, capital remains trapped in capex-heavy giants. If it slows, markets may unwind just as employment weakens. Either way, AI is increasing the US recession risk in 2026—a macro risk hiding inside a technological miracle. AI will change the world—but first, the bubble must clear, revealing who was swimming without a lifeline.

Bitcoin crisis

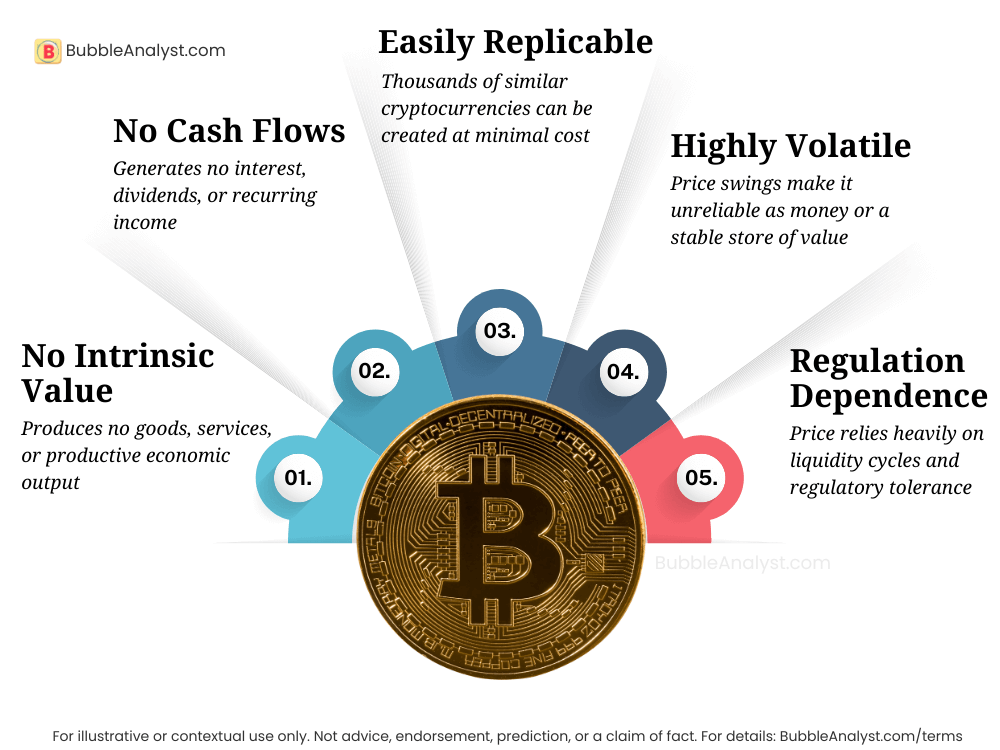

If a recession hits in 2026, most analysts will point to U.S. debt, inflation, or geopolitics. But another risk is quietly building beneath the surface — a potential Bitcoin crisis. The irony is striking: a Bitcoin collapse could actually strengthen the U.S. dollar as a global safe haven, yet still unleash a shock powerful enough to drag the world — and eventually the U.S. — into recession.

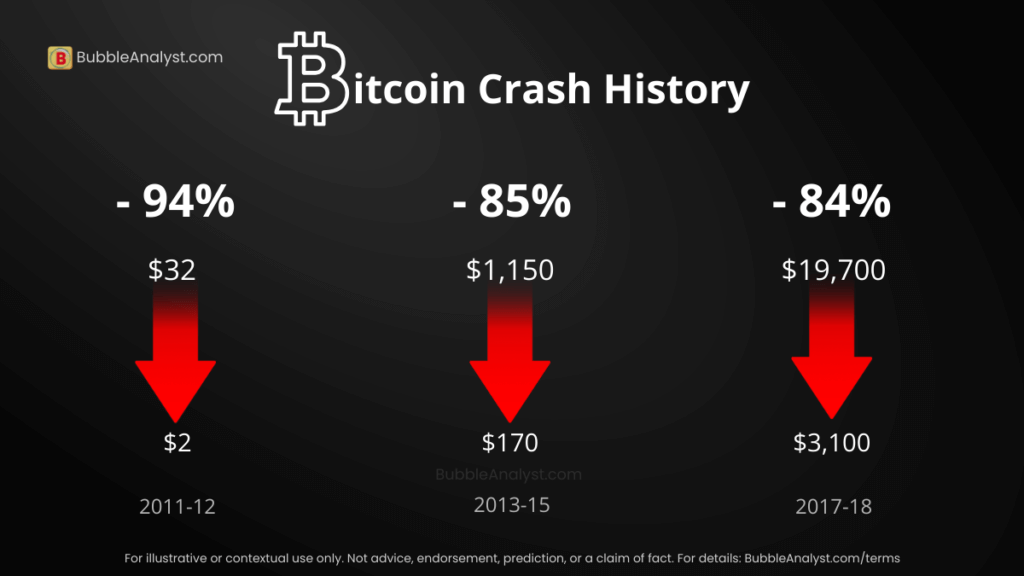

The foundations of this risk have been visible for years. Bitcoin has no earnings, no cash flow, and no intrinsic value. Its price is driven entirely by belief, hype, and liquidity. History is clear: assets priced purely on sentiment eventually collapse — from Tulip Mania to the dot-com bubble. Bitcoin itself has already crashed 70–90% multiple times, behavior no stable currency or reliable store of value should exhibit.

What makes 2026 uniquely dangerous is not just Bitcoin’s fragility, but how deeply it has now penetrated the real economy. Millions of people use crypto wallets. Billions of dollars move through exchanges daily. Countries like El Salvador, along with institutions, hedge funds, and corporations, hold Bitcoin on their balance sheets. A sudden crash wouldn’t just hurt speculators — it could wipe out household savings, destabilize companies, trigger margin calls, and freeze liquidity across markets.

We’ve seen a preview. The FTX collapse erased billions almost overnight, exposing how confidence-dependent the crypto ecosystem really is. Memecoin booms, political token endorsements, and repeated 98% crashes show the same pattern: this market behaves more like a casino than a financial system.

Underlying Cracks in the Economy: The Warning Signs Most People Miss

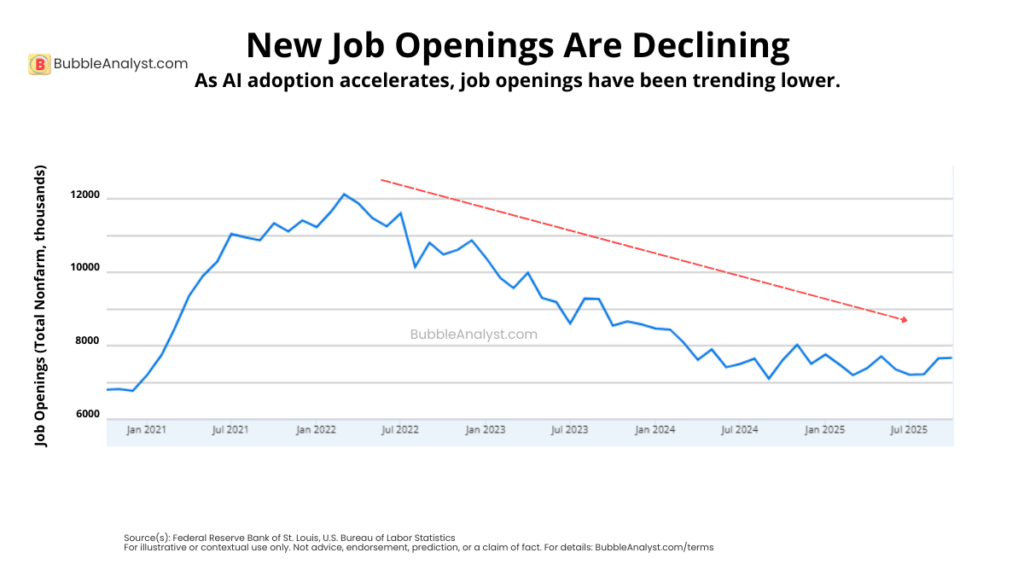

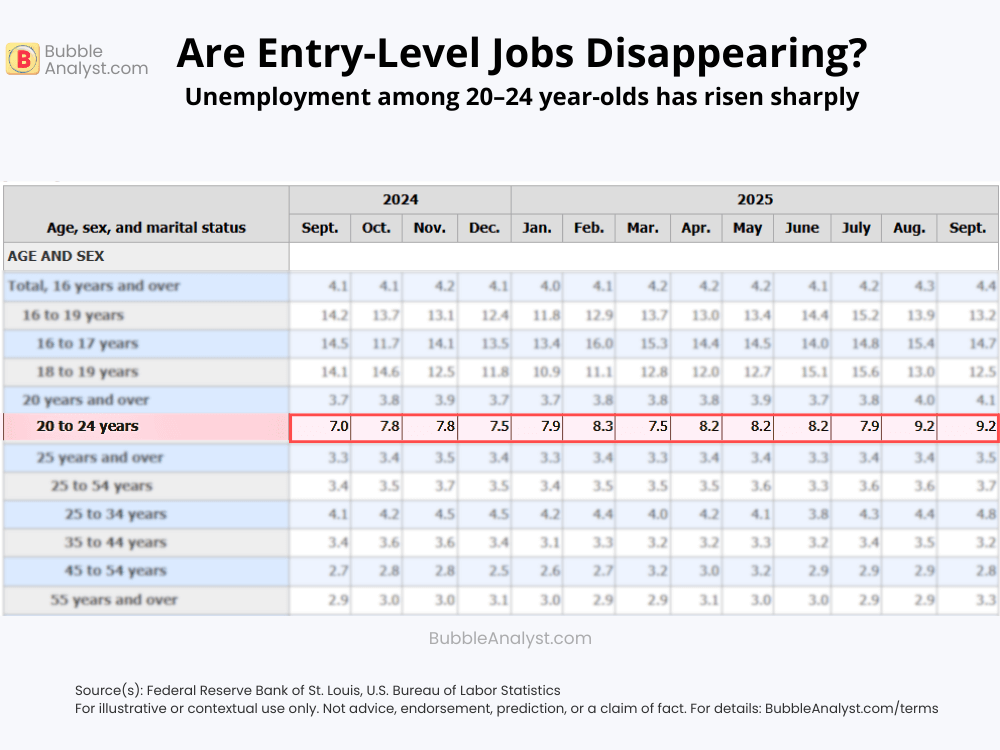

Beneath the surface of “resilient” economic headlines, structural cracks are forming across the U.S. economy. One of the clearest is what can best be described as “jobless efficiency.” Workers aren’t being fired en masse — instead, their positions are being eliminated permanently. Companies are restructuring around automation, AI, and cost efficiency, removing roles rather than people. The result is a labor market that appears stable in aggregate, but increasingly hollow underneath.

This shift is hitting the young workforce the hardest. Unemployment among those aged 20–24 stands near 9.2%, far above the national average. Meanwhile, job cuts have surged to their highest levels since 2020, when COVID forced more than 2.22 million layoffs through November. What is really worrying from the viewpoint of US recession risk in 2026 is that 2025 is only the sixth year since 1993 in which job cuts through November have exceeded 1.1 million.

This is not cyclical belt-tightening — it’s a structural removal of entry-level and mid-skill jobs. GDP data continues to provide a false sense of comfort. Yes, Q2 2025 real GDP rose in 48 states, but growth remains narrow and uneven. A few states are carrying the load — North Dakota surged +7.3% (annualized), while Arkansas contracted −1.1%, with most states clustered weakly around the average. This is why economists like Mark Zandi (Moody’s) caution that GDP is a lagging indicator. In fact, real GDP still grew about 2.5% annualized in Q4 2007, even as the recession officially began and job losses were already spreading.

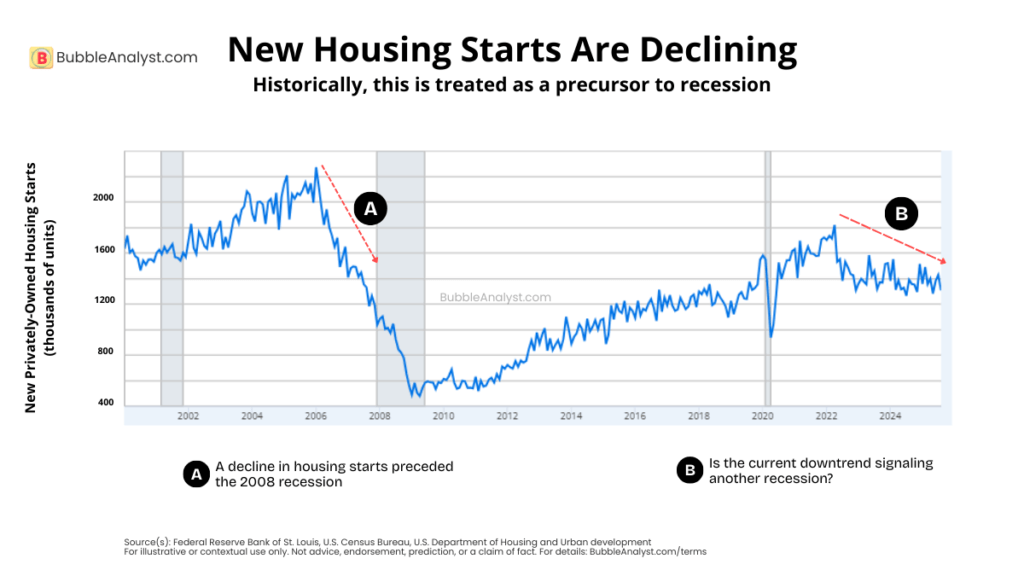

So, will the US enter a recession in 2026? One area that has historically provided leading signals of recessions is housing starts.

New housing starts have trended downward since 2022, a classic leading indicator of recession. Fewer new homes reflect weakening demand, tighter credit, and falling confidence — and housing historically turns down before the broader economy does.

So where is current growth coming from? Largely from massive AI-driven capital expenditure, running into the trillions. While AI will boost productivity long term, this surge increasingly resembles a capex bubble, not broad-based economic health.

Taken together — jobless efficiency, misleading GDP strength, falling housing starts, and AI-heavy capex concentration — the economy doesn’t look strong. It looks imbalanced. And historically, imbalances are exactly what precede recessions.

Geopolitics: A Slow-Burning Fuse for a US Recession in 2026

The Russia–Ukraine war is now in its fourth year, and far from resolution. Russia has gained meaningful territory, but at a staggering cost: millions of lives disrupted or lost, entire cities destroyed, and hundreds of billions of dollars burned by both sides and their allies. Ukraine survives largely on external funding; Russia continues despite sanctions by pivoting trade and energy flows. What’s missing is the most important ingredient: a credible path to long-term peace.

Instead, the conflict has settled into a dangerous stalemate. NATO support persists, Russia escalates incrementally, and the ever-present nuclear risk remains — not as a prediction, but as a tail risk markets cannot ignore. This is increasingly resembling a new Cold War, defined by proxy conflicts, arms buildups, sanctions, and fractured global trade.

At the same time, geopolitical stress isn’t limited to Eastern Europe. Escalatory rhetoric and threats around Taiwan, the Middle East, and expanded sanctions regimes raise the risk that one additional conflict could become the straw that breaks the global system’s back. So, will the US enter a recession in 2026? Well, markets can tolerate one war. But, they struggle with multiple, overlapping geopolitical shocks.

The way these factors increase the US recession risk in 2026 is because of the economic consequences: higher defense spending, disrupted energy and commodity flows, weaker global trade, and persistent inflationary pressure — all while governments are already drowning in debt. Layer this on top of slowing growth, fragile labor markets, and tight financial conditions, and geopolitics becomes a powerful recession accelerator.

Conclusion: Why 2026 Matters

None of these risks — debt, AI, Bitcoin, labor shifts, housing, or geopolitics — are fatal on their own. The danger lies in their timing and interaction. A debt-heavy government has less room to respond. An AI boom that cuts jobs before creating new ones weakens consumption. A Bitcoin shock could tighten global liquidity. And prolonged wars keep inflation and uncertainty alive.

History shows recessions don’t arrive with a single warning — they emerge when imbalances collide. By the time GDP turns negative, the damage is already done.

If a US recession in 2026 occurs, it will not arrive as a surprise—it will be the logical outcome of pressures that are already visible today.