Gold, Bitcoin, or a quiet currency reset — how the US debt reset could erase debt without calling it a default.

Key Points

- Gold reset: Reprice gold higher, make debt look smaller — same problem, new accounting.

- Bitcoin reset: Pull crypto under federal control, shift debt off-balance-sheet quietly.

- Currency reset: Introduce a “new” dollar, use it to settle old promises at lower real value.

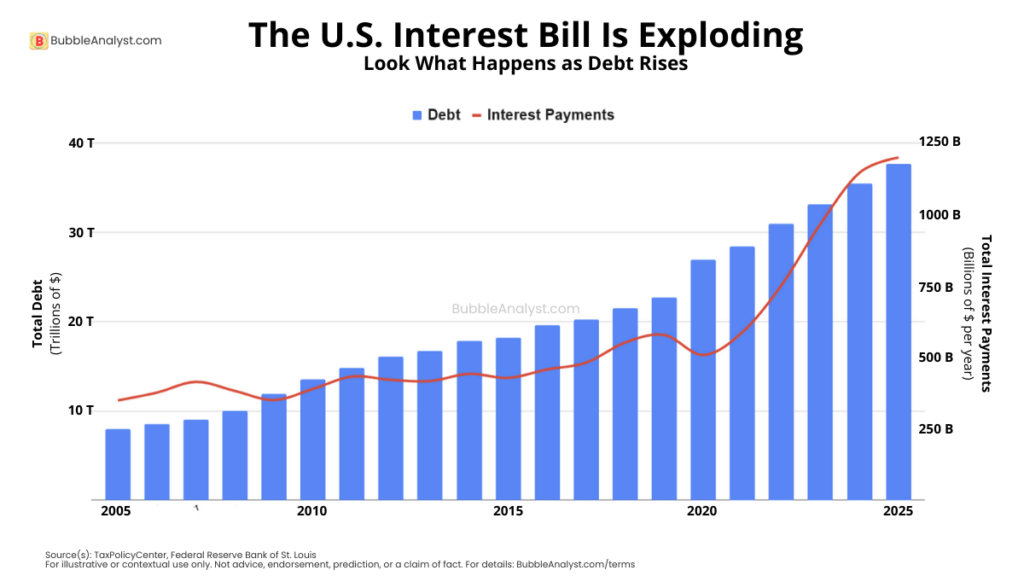

Debt Reset using Gold

Over the last few years, one phrase has quietly made its way into financial discussions, YouTube videos, and macro forums: “Debt Reset”. The most popular version of this idea claims that a new Bretton Woods-style system will emerge, gold will be revalued sharply higher, and massive government debt will somehow be “reset.” It sounds dramatic. It sounds powerful. But does it actually work that way?

Many analysts now believe a US debt reset is no longer a fringe idea but a structural outcome of rising deficits, interest costs, and monetary limits—factors that have significantly increased the risk of a US recession.

Let’s break down the myth vs reality of debt resets — using simple math and real-world financial mechanics.

If Gold Is Revalued Higher, Does Debt Automatically Shrink?

At the heart of the gold-reset theory is this belief: “If gold’s price explodes upward, governments can erase or neutralize their debt.” Let’s test that with simplified numbers.

- U.S. federal debt (approx): $36 trillion

- U.S. gold reserves: ~261 million ounces

At gold prices around $2,000/oz, total U.S. gold value is roughly $522 billion — barely 1–2% of total debt.

Now imagine the government announces a new gold-backed system and revalues gold to $50,000 per ounce.

Suddenly:

- Gold value jumps to $13 trillion

- Debt stays at $36 trillion

Did the debt disappear?

No.

Did interest payments shrink?

No.

Did bond maturities magically reset?

No.

All that improved was the optics of the balance sheet. The cash-flow burden — the actual money needed to service the debt — remains unchanged.

Gold revaluation improves perception, not payment ability.

Why Gold Revaluing wouldn’t help

Debt Is a Cash-Flow Problem, Not a Price-Tag Problem. Governments don’t default because gold is too cheap. They default when they can’t service interest and principal with tax revenue and GDP growth.

Even if gold doubles, triples, or increases tenfold:

- Treasury bonds still require fixed dollar payments.

- Interest still compounds based on outstanding debt.

- Budget deficits still funnel new borrowing into the system.

That’s why a goldbased US debt reset will not erase the debt. It can restore confidence, but it does not replace cash flow. Something else needs to be done because the US debt crisis has now reached a scale where inaction is no longer viable.

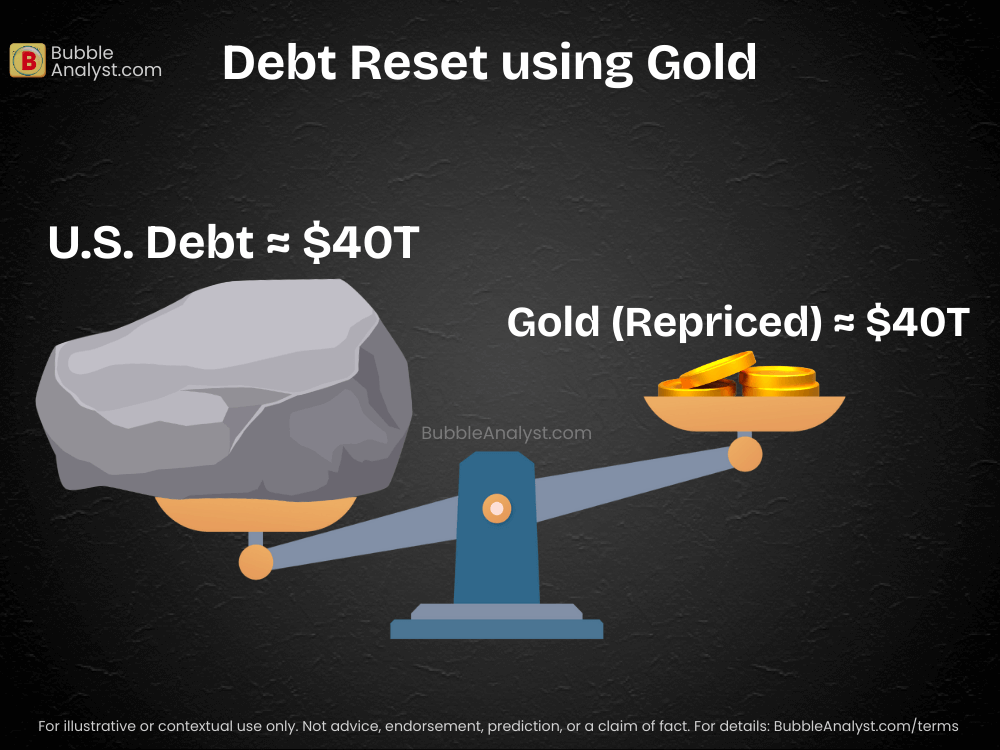

Debt Reset using Crypto

Yes, Russia suggested this. But even before Russia said it, Trump himself admitted it. In an interview with Maria Bartiromo of Fox News, Trump hinted at Bitcoin’s potential role in resolving the national debt, suggesting, “Who knows, maybe we’ll pay off our $35 trillion dollar [national debt], hand them a little crypto check, right? We’ll hand them a little Bitcoin and wipe away our $35 trillion.” Just let this settle down a bit — as this could be the exact way a Bitcoin based US debt reset may look.

US debt reset using crypto could look like this:

- The U.S. could eventually shift part of its national debt into the “crypto cloud,” while crypto is high.

- US debt investors (especially foreign investors like China) get debt moved to crypto denominations.

- If crypto crashes in future, blame lies on the crypto ecosystem, and not the US treasury.

It’s a financial sleight of hand: the liability is transferred into a system designed to absorb failure.

And when investors ask who is responsible for this bitcoin debt reset?

Not the Treasury.

Not the Fed.

Not the dollar.

Just one final question echoes through the wreckage:

Where is Satoshi Nakamoto? The founder of Bitcoin, only catch is – no one knows who he/she/they is?

Think of it like the fictional example from the hit series ‘The Office’: Creed doesn’t go bankrupt — he simply moves his debt onto someone else’s balance sheet.’ Governments can’t disappear debt either. They reassign it across time, currencies, and populations.

GENIUS Act: First Step Toward a Debt Reset?

On the surface, the GENIUS Act is not a debt-reset mechanism. The law creates federal rules for stablecoins (SC) – requiring issuers to hold 100% reserves in cash and short-term U.S. Treasuries, publish monthly reserve disclosures, and comply with AML and sanctions regimes. In short, it aims to make “crypto dollars” safe, transparent, and fully embedded within U.S. financial and national-security infrastructure.

From a macro perspective, the Act may actually increase demand for Treasuries. As stablecoin adoption grows, issuers must park more capital into U.S. government debt to back their tokens. This helps finance the debt—but it does nothing to reduce the existing US debt burden.

Crucially, if 1 stablecoin (SC) remains legally and practically redeemable for 1 U.S. dollar, then its market price is largely irrelevant. Even if SC trades at $0.000001 in secondary markets, holders can still demand redemption: “I don’t care about the market price—give me my dollar.” As long as that promise stands – AND is backed by US treasury/ US dollar – the risk never leaves the dollar system. The liability hasn’t disappeared; it has merely been repackaged into a token.

A true US debt reset would require breaking this redemption link. Only if the government limits, delays, or refuses stablecoin redemptions—under some ‘legally justified’ pretext—does the burden shift away from the sovereign balance sheet. In that scenario, stablecoin collapse could absorb part of the shock. Whether that outcome is accidental or strategically designed is the real question hiding behind the word “GENIUS.”

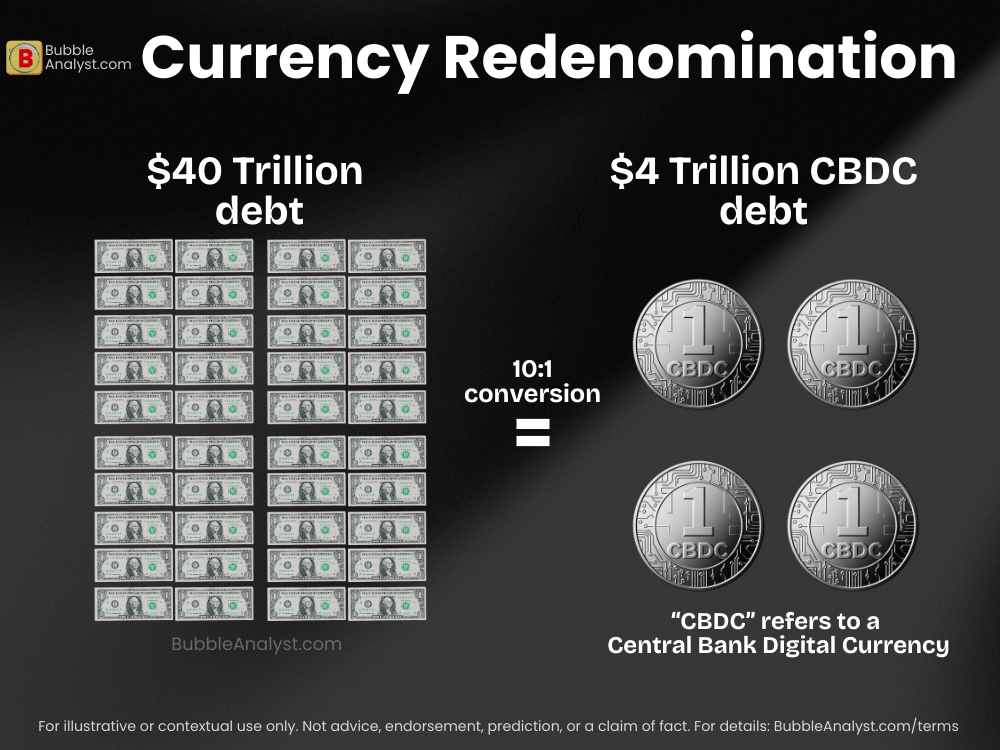

US debt reset through Currency Redenomination

The most blunt instrument is currency redenomination—changing what each “unit” represents. Classic versions are:

- 10 old units → 1 new unit,

or - Converting domestic debt into a new tier of money, while keeping an external or “hard” version for global use.

For a country like the U.S., outright redenomination of the ‘global’ dollar is tricky because it’s the world’s reserve. But conceptually, a sophisticated version could look like:

- Introduction of a “New Dollar” or “Digital Dollar” for domestic use, with conversion rules for old claims.

- Certain categories of government obligations are forcibly redenominated into the new unit, while external obligations (to foreign central banks, for example) are kept the same.

- Over time, pricing, wages, and taxes fully shift into the new unit.

This could be done under the pretext of modernizing the currency system, fighting corruption, fixing legacy imbalances, and protecting ordinary citizens.

Behind the scenes, redenomination lets the state compress the real value of legacy promises in a controlled way. The brand “dollar” can be preserved (especially outside the U.S.), even if what that dollar represents inside the system has changed – in this case, the U.S. debt reset would be achieved through simple math conversion.

Again, the pattern is the same:

- The math doesn’t disappear.

- Someone absorbs the loss.

- But the blame is attached to the transition mechanism, not to the idea of “the dollar” itself.

Debt Haircut

The final option could be a debt haircut: investors holding $100 face value end up with, say, $60–$80 in new bonds. Normally, that’s called default. But with the right legal tools and narrative, a government can still try to protect the “legitimacy” of the currency.

This would be an optics-managed US debt reset:

- The government declares an extraordinary financial stabilization program.

- Old bonds are exchanged into new series with reduced face value, reduced coupon, or both.

- Domestic depositors, small savers, and politically sensitive groups may be protected or compensated to preserve internal trust in the system.

- Foreign holders, large institutions, and certain classes of bonds (especially under local law) take the bulk of the hit.

In this scenario, the US debt reset could preserve the dollar’s global role while admitting that some investors had to “participate in the solution.”

Conclusion

A US debt reset will not be some magical event — instead, it will be a distribution mechanism for loss. Whether framed through gold repricing, crypto integration, redenomination, or selective haircuts, the underlying math never disappears. What changes is who absorbs the damage, when it is absorbed, and how it is explained. Gold can restore confidence but not cash flow. Crypto can repackage liabilities, not erase them. Redenomination and haircuts can compress promises, but only by shifting pain across populations and balance sheets. History shows one constant: governments don’t eliminate debt—they reassign it quietly, behind legal frameworks and persuasive narratives.