Key Points

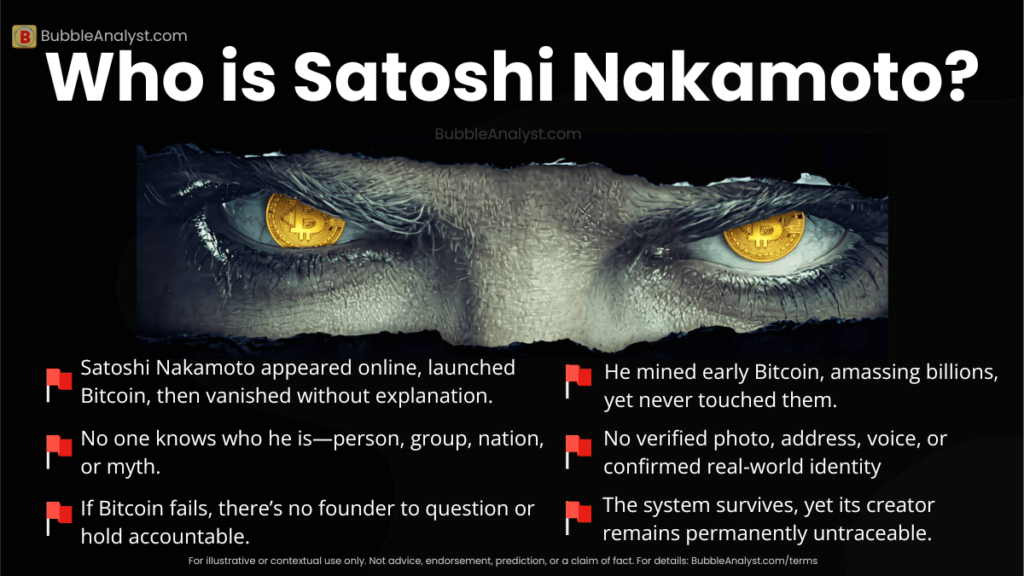

- Bitcoin has no earnings, cash flow, or intrinsic value — making it behave like a sentiment-driven bubble. In fact no one knows who the creator is.

- Bitcoin has crashed up to 90% in the past, and still remains highly vulnerable to hype and manipulation.

- Many experts have called Bitcoin a ponzi scheme, and if Bitcoin were to collapse tomorrow, there would be NO ONE to put a blame on, because no one knows who the founder Satoshi Nakamoto is.

Introduction

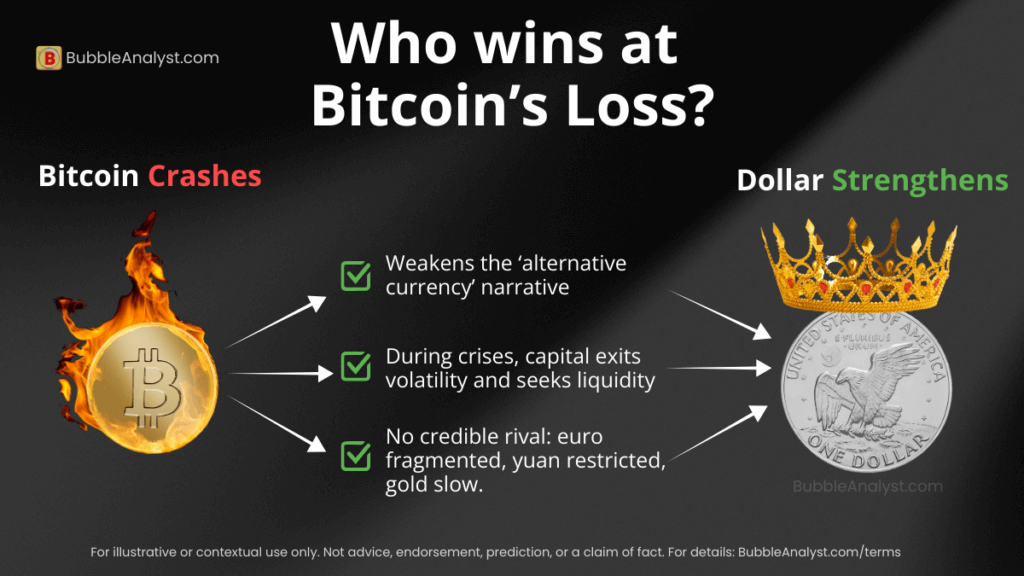

If Bitcoin collapsed tomorrow, the biggest winner wouldn’t be a hedge fund, a VC, or a crypto exchange. It would be the U.S. dollar — the very system Bitcoin was created to escape.

Understanding the motive behind something is often more important than the act itself. If creating and crashing Bitcoin was a crime, the motive could be to save the US dollar.

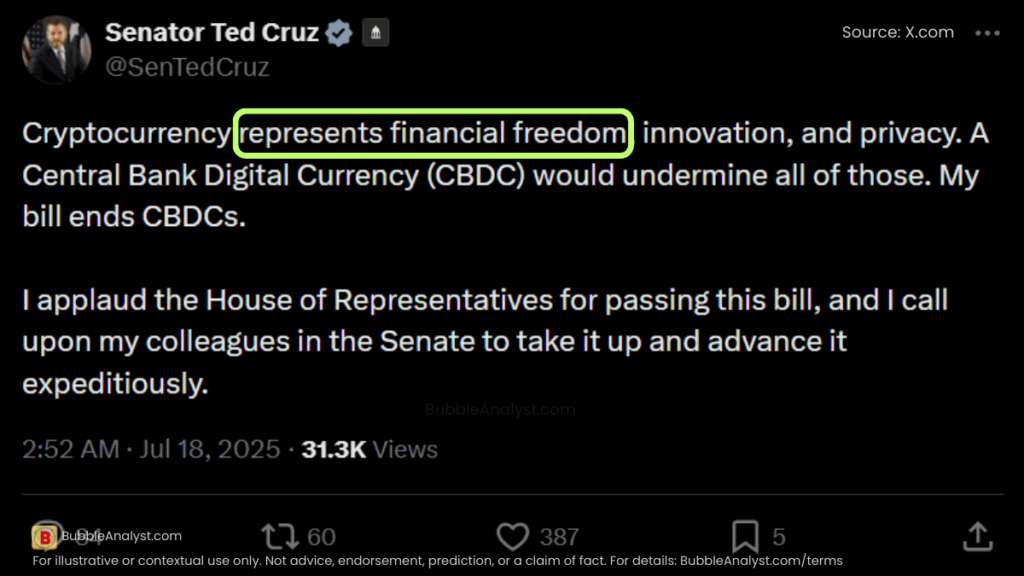

Many investors quietly wonder: is Bitcoin a scam, or just another financial bubble shaped by hype? But before they do research, they hear words directly from the ‘trusted’ people that Bitcoin represents ‘decentralized freedom’. The dollar represents centralized control. And they think, well if everyone’s in it, it must not be a scam.

But before you buy into any political “freedom” speeches, ask yourself: Is the government protecting your liberty, or protecting its leverage—especially as the US debt spirals out of control with little concrete action to address it?

Here are the 9 reasons why we believe Bitcoin is the bubble of the century, why experts remain skeptical, and why the risks are far greater than most investors realize.

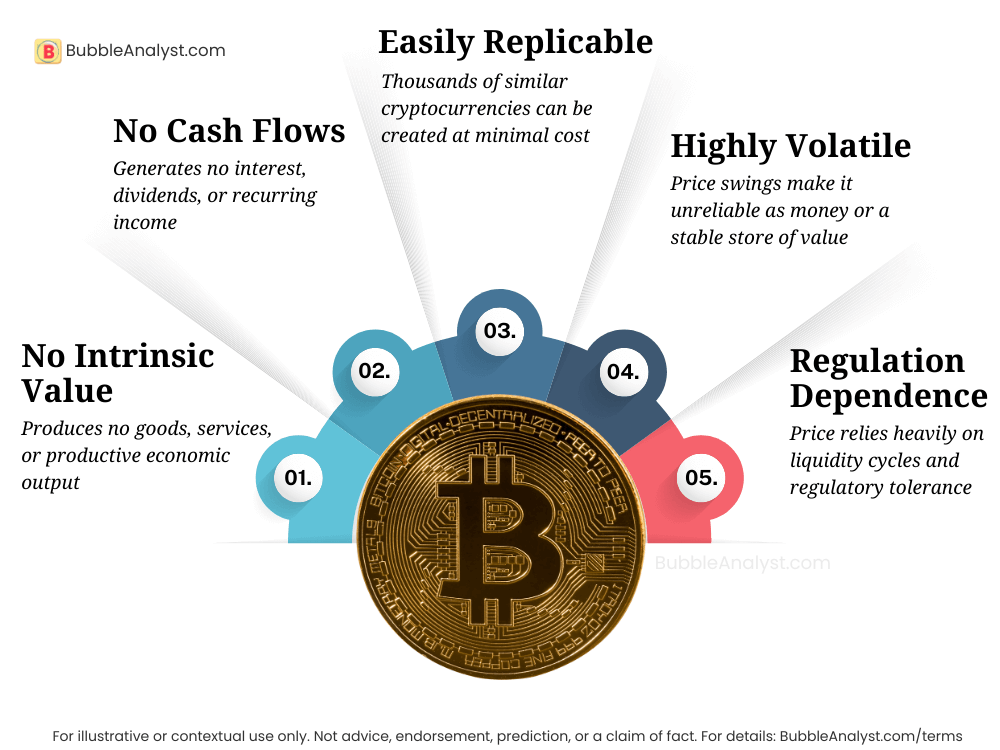

1. Bitcoin Has No Intrinsic Value

Traditional investments can be valued:

- Stocks have earnings.

- Bonds have interest.

- Real estate has rental income.

- Commodities have industrial use.

In fact, gold also has intrinsic value because it is widely used in jewelry and industrial applications across the world. Bitcoin has none of these—which is why, in a Bitcoin vs gold comparison, gold continues to stand on fundamentally stronger ground.

It does not generate cash flow. It does not produce anything. It does not have real-world utility beyond speculation.

Its price is purely:

- What someone else is willing to pay, and

- How much collective belief exists in the system.

When belief fades, the price collapses — sometimes overnight.

This is why Warren Buffett, Charlie Munger, Howard Marks, and Mohnish Pabrai all classify Bitcoin as a “speculative asset”, not an investment. So, before jumping in, every new investor should honestly ask: should I buy Bitcoin, or am I just following the crowd?

2. Extreme Price Volatility Signals Bubble Behavior

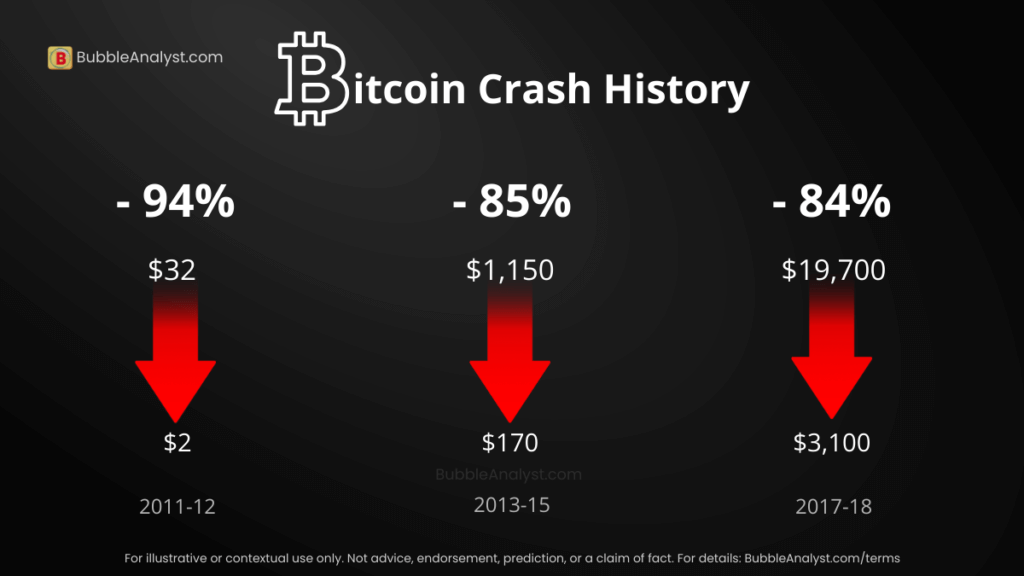

Bitcoin has crashed upto 90% multiple times — something no stable currency or reliable store of value should ever do. Just look at the history:

• 2011-12: $32 to $2 (94% crash)

• 2013-15: $1,150 to $170 (85% crash)

• 2017-18: $19,700 to $3,100 (84% crash)

These aren’t normal corrections. They’re classic bubble patterns — a sudden surge, mass excitement, and then a complete wipeout. Can you imagine ‘any’ company’s stock or any country’s currency (in fact, even Gold) crashing 90%? What would be the reaction of the market?

Even when stocks, real estate, or gold crash, they almost never fall this hard, this fast, or this often. Bitcoin’s volatility isn’t a “feature”. It’s a reminder that the story and the reality don’t always match. Before investing, it’s worth asking honestly — is Bitcoin a scam or just a risky bet with no guarantees?

3. Bitcoin Depends Entirely on Sentiment (Tulip Mania 2.0)

Bitcoin is priced in US dollars — the same system it claims to replace.

Its value increases only if:

- More people believe in it

- More money flows into it

- The hype cycle continues

This is almost identical to a past bubble that happened centuries ago – Tulip bubble.

Tulip Mania in the 1630s was the world’s first viral asset bubble — Tulip was a ‘fancy’ flower, whose prices soared simply because people thought someone else would pay more tomorrow. When belief cracked, tulip prices collapsed overnight. One thing everybody forgot to ask was what is the ‘real value’ of a tulip flower. Everyone bought, because they saw everyone else buying.

Bitcoin shows similar psychology: rapid hype, no intrinsic value, and complete dependence on collective faith. When you strip away the excitement, the Bitcoin bubble explained is simple: price rises only as long as belief rises. But in all this hype people are forgetting that nobody even knows the answer to the very basic question: who is Satoshi Nakamoto? The alleged creator of Bitcoin.

When sentiment flips, and when people start selling, a bitcoin crash would become inevitable.

Supporters claim Bitcoin is a store of value, but history shows assets without fundamentals rarely hold value forever.

4. The FTX Collapse Exposed the Crypto System’s Weakness

FTX was once one of the world’s biggest crypto exchanges, but its sudden collapse showed how fragile and ‘trust-dependent’ the entire crypto space really is.They created their own token, FTT — a coin with no real utility, no intrinsic value, and no independent backing (like Bitcoin). But because enough people “believed” in it, billions of dollars of “value” appeared out of thin air.

FTX then used this self-made token as collateral to borrow real dollars — basically printing digital Monopoly money and treating it like actual wealth. The moment confidence cracked, token crashed 98%, and FTX collapsed almost overnight, wiping out billions.

And here’s the real problem: FTX wasn’t unique. Hundreds of tokens work on the same shaky model — and many could fall just as fast – including Bitcoin.

Most people underestimate the risks of Bitcoin investing — from volatility, to regulation, to total loss of capital.

5. Memecoin Surges Show How Easily the Market Is Manipulated

In early 2025, political celebrities publicly acknowledged certain meme tokens. Within hours prices surged several hundred percent, Market caps hit the billions.

And just as quickly, the coins collapsed over 98%. Early insiders reportedly profited massively, leaving everyday investors with losses.

These events show:

- The market is highly unregulated

- Pump-and-dump cycles can be termed ‘legal’ somehow

- Retail investors are usually the ones left holding the bag

- Bitcoin may be more established than a meme token, but the pattern of hype-driven speculation is the same.

So let’s come back to the main question: is Bitcoin a scam? If a currency system is built entirely on hype — with no fallback, no guarantees, and no one accountable — what happens if it simply disappears? With billions at risk and nobody to blame, does it really sound like a “safe” financial system or a scam?

6. Bitcoin Mining Has Enormous Hidden Costs

Bitcoin ‘mining’ consumes 138–172 terawatt-hours (TWh) of electricity per year — as much as a mid-sized country like Egypt.

This creates several problems:

A. Energy Drain in Emerging Economies

Countries hoping to profit from mining may divert electricity away from:

- Hospitals

- Schools

- Industrial units

If Bitcoin crashes, the result is stranded infrastructure and wasted national resources.

B. Noise Pollution

Mining farms aren’t silent. Many US towns (especially in Texas, which Ted Cruz is marketing as an oasis for crypto) report 90–100 dB noise inside homes — louder than legal limits.

The environmental + economic + health burden is often ignored, but it’s massive.

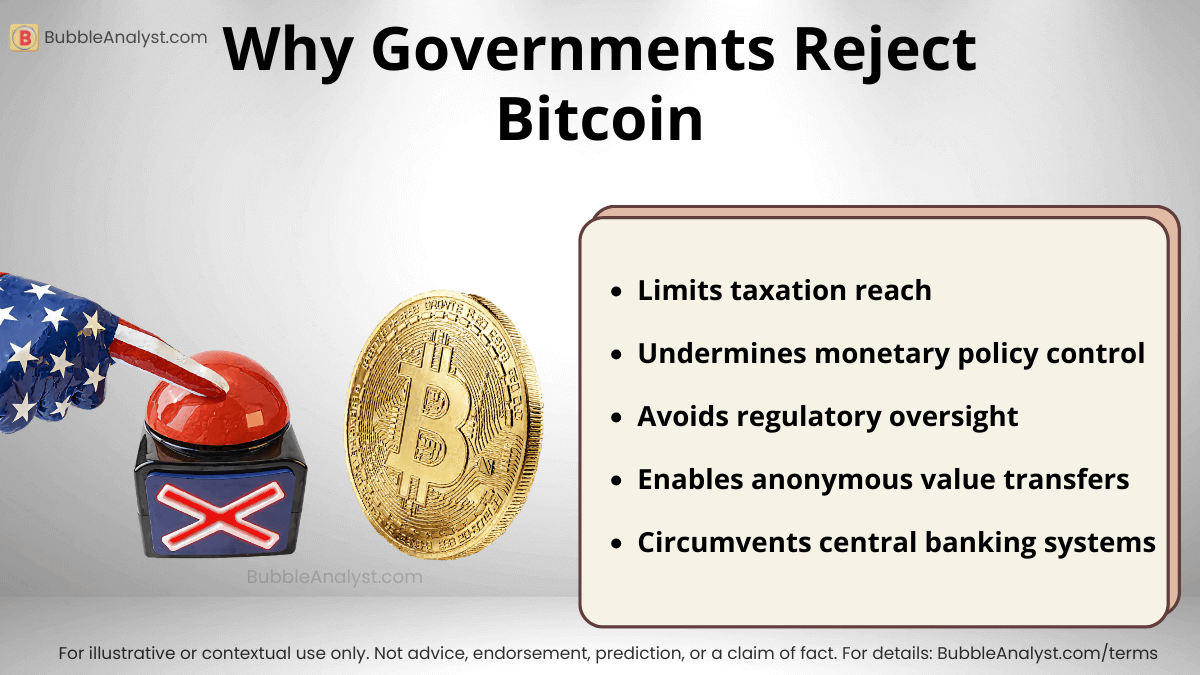

7. Governments Will Never Allow a Currency They Can’t Control

No government will support a system that:

- Limits taxation

- Avoids regulatory oversight

- Circumvents central banks

- Enables anonymous money transfers at scale

Bitcoin’s original promise — to “replace” fiat money — is precisely why governments will regulate it, tax it, restrict it, or contain it. Bitcoin’s goals conflict with state power, making long-term stability unlikely.

In many ways, the real battle isn’t crypto vs crypto—it’s Bitcoin vs the US dollar, and which system ultimately retains trust. That raises a more uncomfortable question: could Bitcoin be serving as a mechanism within a future US debt reset, rather than a true long-term store of value—or is it simply hype masking deeper systemic intent?

8. Unlimited Competition Weakens the “21 Million Scarcity” Argument

Yes, Bitcoin has a capped supply.

But crypto has:

- Over 20,000 alternative coins

- Unlimited future competitors

- Tokens that can be created in ‘minutes’

If scarcity alone created value, then every limited-supply crypto coin should be worth a fortune — which clearly isn’t the case. And once again, comparing Bitcoin with gold is also flawed. Gold has no real competitor. No other metal fully replaces what gold is used for, whether in jewelry, electronics, or industry. We’re not defending gold here — we’re simply saying that even on the question of ‘scarcity value’, Bitcoin is actually weaker than gold.

9. Bitcoin may be the Trojan Horse to save the Dollar

We’re not saying this theory is proven—but with US recession risk now significantly elevated, some analysts raise an interesting possibility: since the real creator of Bitcoin is still unknown, it may not be as ‘independent’ as it appears. One theory is that it could function like a Trojan horse—designed to rise first, then collapse at a moment when the U.S. dollar is weakest, precisely during periods of economic stress.

Here’s the logic behind that thinking:

- The U.S. dollar today faces visible pressure from the euro, BRICS talks, and rising national debt.

- At the same time, Bitcoin presents itself as an “alternative global currency,” even though many investors still wonder whether Bitcoin is a scam or simply another speculative bubble.

- Now imagine what happens if Bitcoin crashes massively. Trust in ‘alternative money’ could collapse along with it.

- In panic, investors may rush back to the only currency still seen as globally stable — the U.S. dollar.

In that scenario, a Bitcoin crash wouldn’t weaken the dollar — it could actually strengthen it. Markets often behave this way: when alternatives fail, the dominant system becomes even stronger.

Is Bitcoin a Scam? And how long can it really survive?

For the first question, we leave it to you to decide who stands to gain the most if Bitcoin collapses – and draw your own conclusion from that.

As for the second question, yes, Bitcoin could survive for several years. It may even get treated like “digital gold” for a while. But in the long run, based on the risks discussed above, we believe Bitcoin will eventually crash.

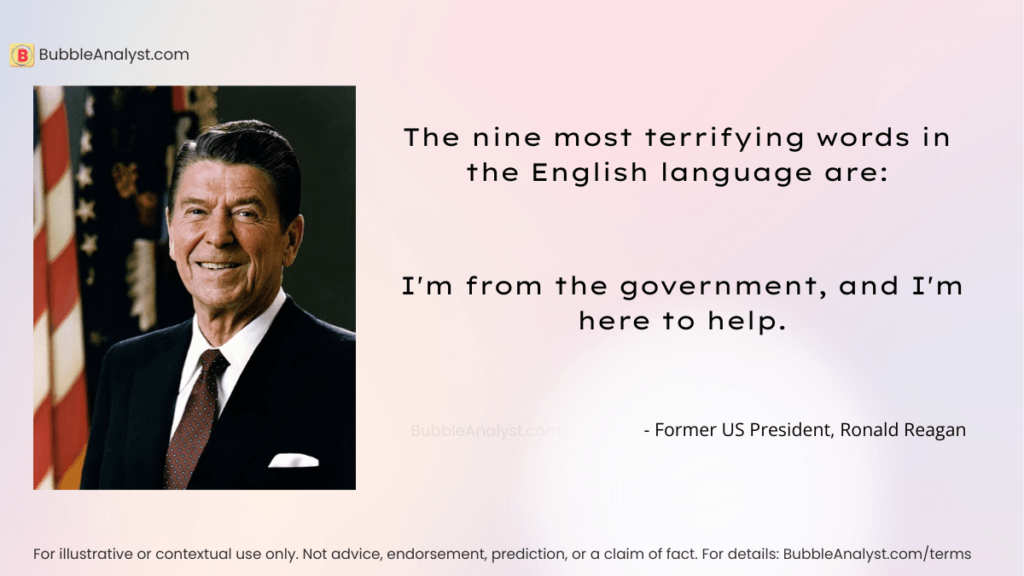

But what about all the Government support around Bitcoin? What about top politicians rallying around bitcoin, and touting how it represents ‘financial freedom’? Well, if you’re one of those who really believe the Government is trying to help you, here’s a gentle reminder from a previous President.

This line hits harder today — in a world where financial freedom, digital surveillance, CBDCs, and government-controlled money systems all intersect. In the end, the question isn’t just about crypto prices. It’s about power, control, and who really benefits when things go wrong — which is why so many investors still ask: is Bitcoin a scam, or just a very risky experiment?