5 Reasons Why Gold Is a Better Investment Than Bitcoin

Key Points:

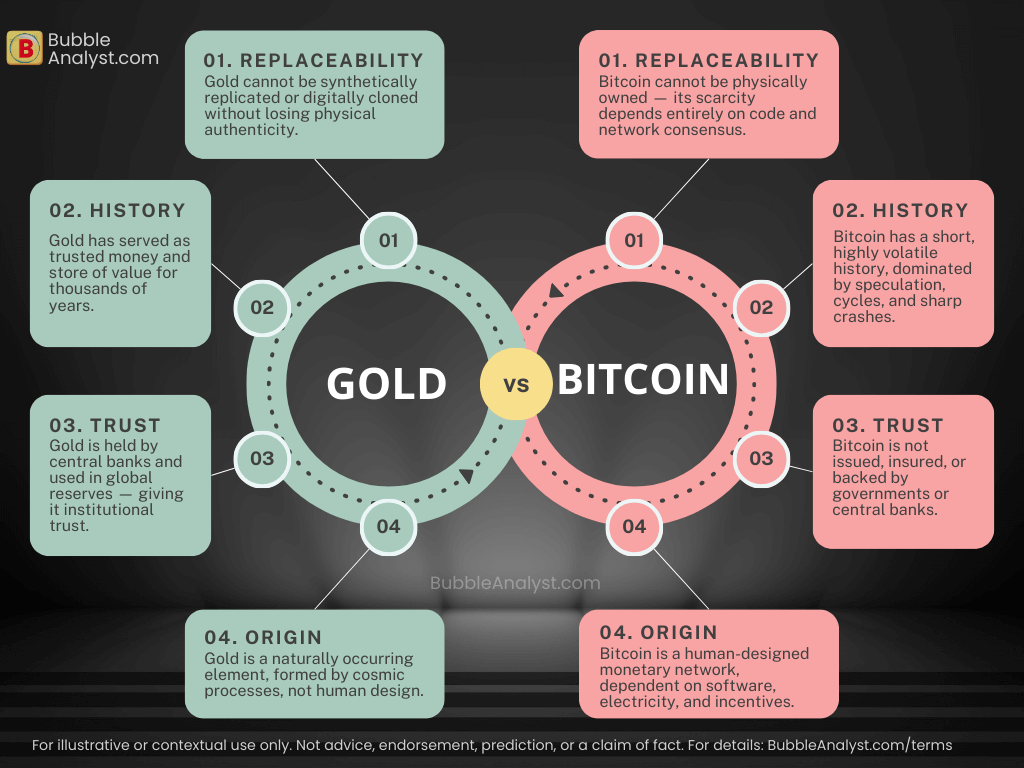

- Intrinsic Value (Bitcoin vs Gold): Gold has real-world utility in jewelry, electronics, and industry. Bitcoin has no physical use – its value depends entirely on belief.

- Irreplaceability: Bitcoin can be copied endlessly – thousands of coins exist. Gold cannot be manufactured or replicated – it’s a natural, rare element.

- History & Stability: Gold has 5,000+ years of proven trust. Bitcoin is only 15 years old and has crashed up to 90% multiple times.

- Government Acceptance: Countries across the world buy Gold as reserves. Bitcoin faces bans, restrictions, and uncertain regulation.

- Origin: Gold is a natural creation; Bitcoin is man-made and easily replaced by new tech.

Intro

When people compare Bitcoin vs Gold, Bitcoin is often called “digital gold.” But when you actually look at gold vs bitcoin as investments, they behave very differently. And yes—the technology behind Bitcoin is interesting. The hype, the price swings, the excitement… all of it makes for great headlines—even as some critics continue to label Bitcoin a scam or a Ponzi-style scheme.

But when we strip away the noise and compare Bitcoin with actual gold — one of the oldest, most trusted assets on Earth — the difference becomes crystal clear.

Here are five solid reasons why gold is still a better investment than Bitcoin, especially if you’re thinking long-term, stability-focused, and reality-based.

1. Bitcoin Has No Intrinsic Value — Gold Does

Many investors compare bitcoin vs gold investment because both are seen as ways to protect wealth. But, let’s start with the basics that many people forget.

Gold has intrinsic value. Bitcoin does not.

Gold is used everywhere — jewelry, electronics, aerospace, dentistry, medical devices, and even in satellite components. It has physical properties that make it unique:

- It doesn’t corrode

- It’s highly conductive

- It’s malleable

- It looks beautiful and is culturally valued worldwide

People want gold for reasons beyond “Number go up.”

Now compare that with Bitcoin.

Bitcoin’s entire value depends on belief — nothing more. If the belief drops, the value drops. If the hype drops, the value drops. Unlike gold, if Bitcoin disappeared tomorrow, there would be zero disruption in any ‘industry’ (except, maybe for the finance industry). No factory would stop, no jewelry market would crash, no electronics manufacturer would panic.

This alone makes gold a far more grounded, real asset. Something you can touch, feel, use, and exchange — even in a world without internet, electricity, or blockchains.

Bitcoin? Switch off the servers and you’re left with… nothing. This is why, in the Bitcoin vs Gold comparison, gold clearly has real, physical value.

2. Bitcoin Is Easily Replaceable — Gold Is Irreplaceable

This is where the “digital” nature of Bitcoin becomes its biggest weakness.

Bitcoin supporters often brag about its limited supply of 21 million coins. But supply-limit means nothing if:

Anyone can create a new “Bitcoin-like” coin in minutes.

And that’s exactly what has happened.

There are:

- Thousands of similar cryptocurrencies

- Meme coins that get pumped overnight

- Even a Trump-themed coin

- Dogecoin (created as a joke)

- Shiba Inu (created in minutes)

- “Utility” coins that have no real utility

Every few weeks a new crypto appears, and many die just as quickly.

This means Bitcoin is not special — it’s just the first popular version of a type of product that can be infinitely replicated.

Now compare this with gold.

Gold is:

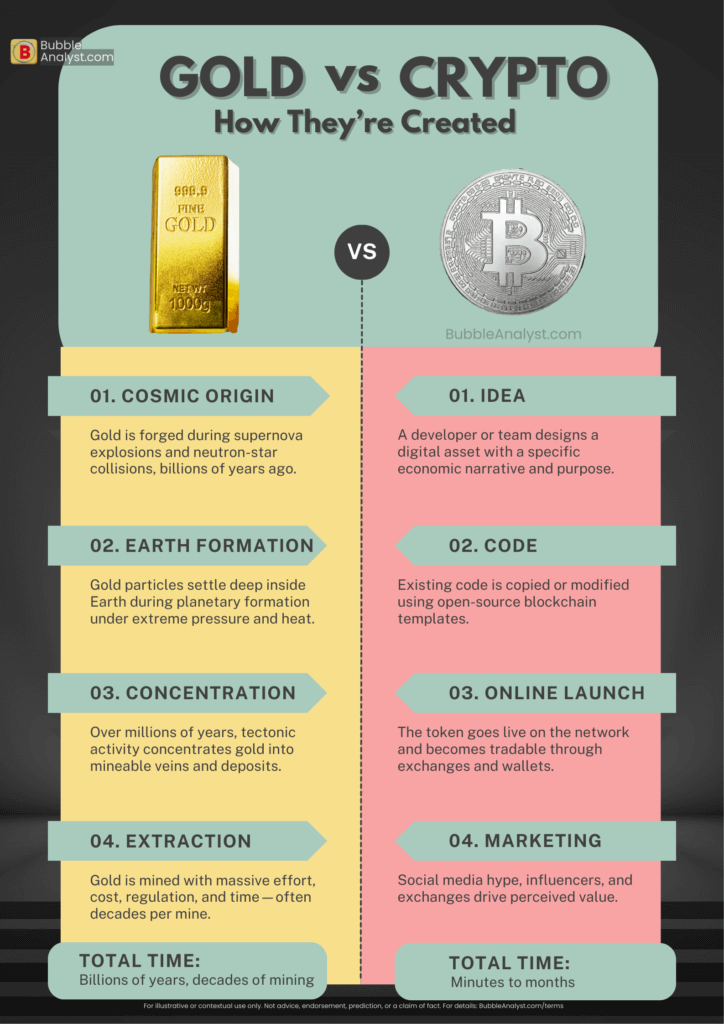

- A physical element

- A real metal on the periodic table

- Rare

- Impossible to manufacture cheaply

- Formed, literally, in ‘stars’ through supernova explosions

Let that sink in: Gold is literally cosmic.

Human beings cannot create gold in a lab without spending more money than the gold would ever be worth. It is naturally scarce.

Bitcoin disappears if the internet disappears.

Gold remains, even if the whole of humanity disappears.

In every application where gold is currently used — ornaments, circuits, medical tools — nothing else fully replaces it. Silver comes close in some industrial use-cases, but even silver cannot replace gold in jewelry culture or high-reliability electronics.

Gold is irreplaceable. Bitcoin is… copy-paste—and as the US debt situation deteriorates to the point where a debt reset may become unavoidable, gold’s role as a monetary anchor only grows clearer.

And when investors compare gold vs bitcoin, natural scarcity matters.

3. Bitcoin vs Gold: History, Crashes, and Long-Term Trust

Gold has survived:

- Empires

- Wars

- Pandemics

- Financial collapses

- Currency failures

- Technological revolutions

For 5,000+ years, humans across continents have used gold as:

- A currency

- A store of value

- A symbol of wealth

- A form of savings

Gold has never gone to zero. Gold has never been “hacked.” Gold has never needed electricity or software updates.

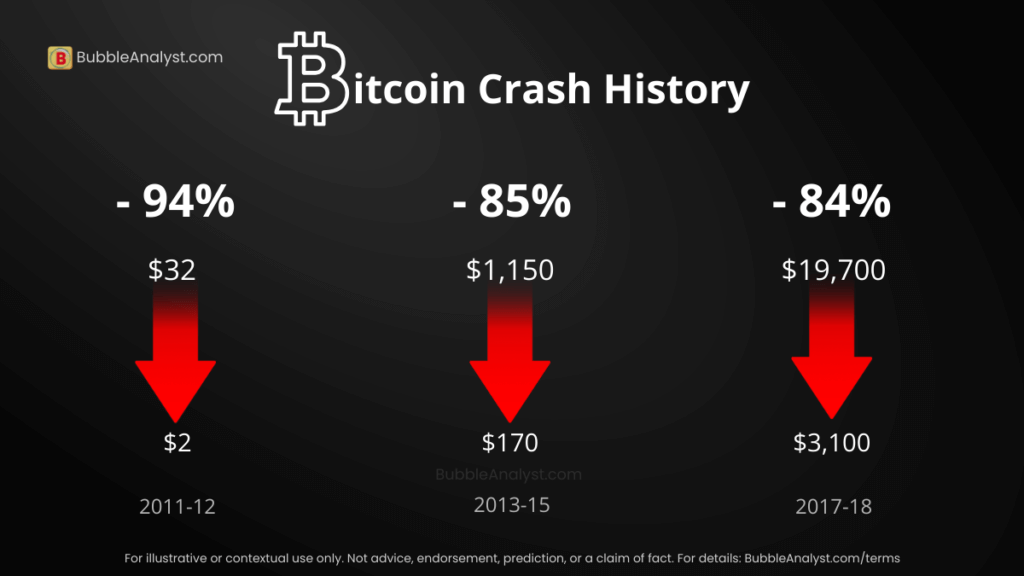

Bitcoin, on the other hand, is extremely recent — only decades old — and in this small timeline, it has already crashed up to 90% multiple times:

- 2011: -94%

- 2013–15: -85%

- 2017–18: -83%

- 2021–22: -77%

No reliable store of value behaves like this, especially when comparing Bitcoin vs Gold over time.

Imagine buying a house and being told, “By the way, the value may drop 90% in a year.” Who would call that a store of value? This is why, in terms of bitcoin vs gold risk, gold remains far more stable—especially as the US debt crisis deepens and investors gravitate toward assets with proven monetary stability.

Gold is steady. Bitcoin is speculation.

4. Gold Is Globally Accepted by Governments — Bitcoin Is Not

Here’s a very simple test: If you walk into any country with gold, you can sell it within minutes. No questions asked. Every government accepts it. Every culture understands its value.

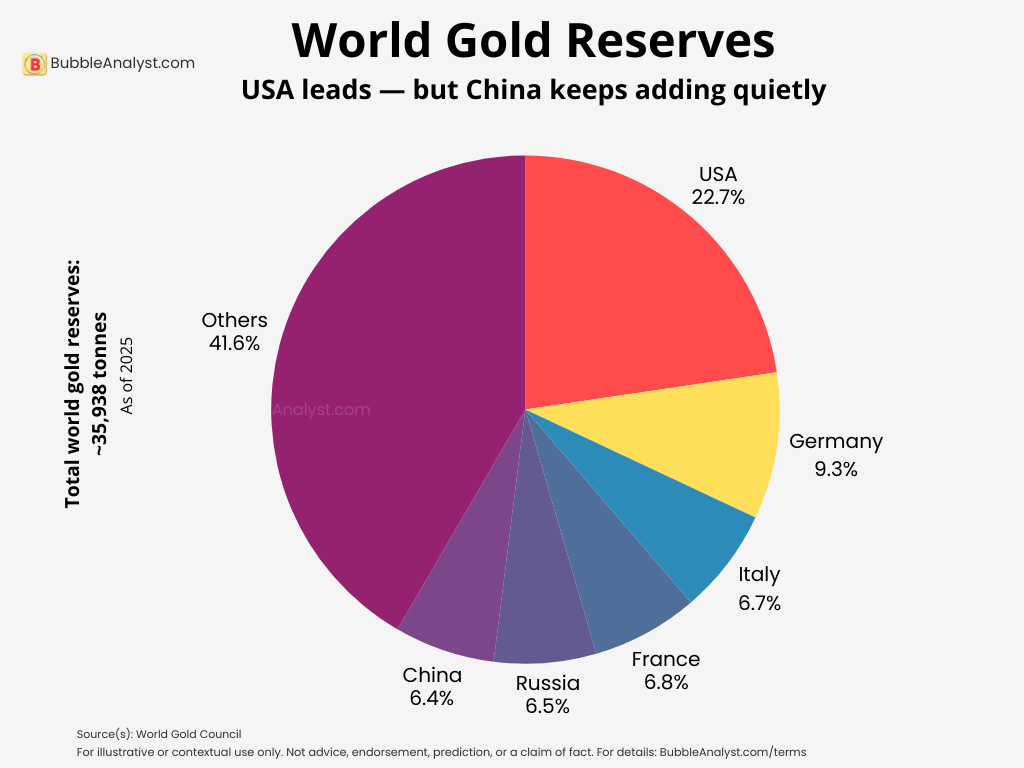

Even global powers use it as part of their national financial strategy.

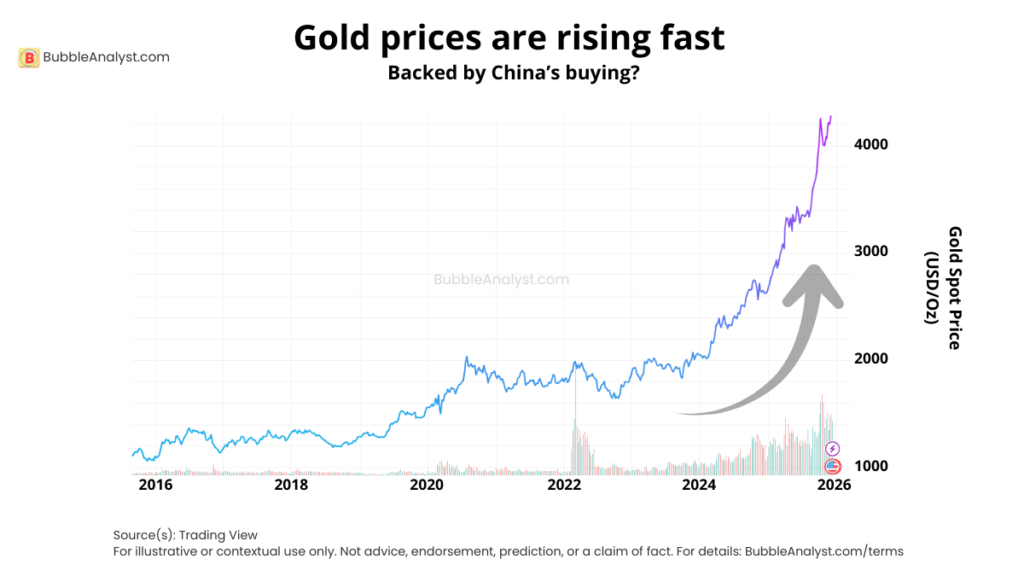

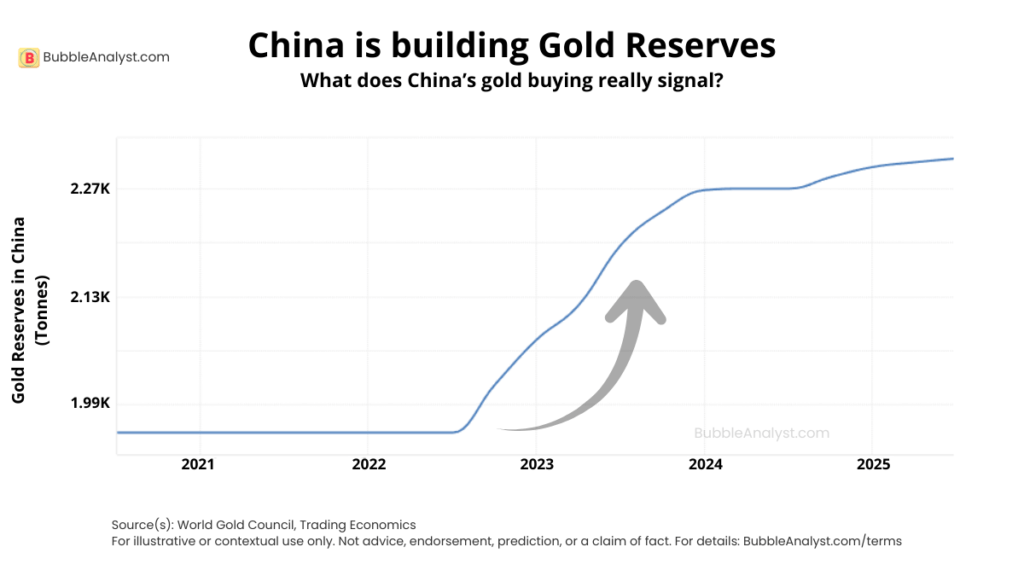

China is aggressively building massive gold reserves to support the legitimacy and long-term stability of its currency, the yuan—a strategy that gains relevance as US recession risk rises and gold increasingly regains its role as a backup currency of last resort.

On the other hand – China banned Bitcoin. India restricts it. The U.S. regulates it heavily and still hasn’t given it full clarity. No major country treats Bitcoin as legal tender.

Bitcoin’s regulatory status is extremely uncertain:

- It can be banned overnight (as seen in China)

- It can be taxed heavily

- It can be restricted

- It can be categorized as a digital commodity, security, or speculative asset depending on the government’s mood

Governments still trust gold far more than Bitcoin. Most governments remain cautious about Bitcoin.

5. Gold Has a Divine Founder — Bitcoin Has a Human Founder

This point is philosophical, but it matters.

Gold was created by God, or by the universe if you prefer a scientific explanation. It is a natural element. Humans cannot manufacture it ‘easily’. It exists because of cosmic processes far beyond our control.

Bitcoin, on the other hand, was created by someone named Satoshi Nakamoto — a mysterious human (or group of humans). We still don’t know who that person is. But one thing is sure:

Bitcoin is a human invention. Gold is not.

And remember what happens with human inventions:

- They get copied

- They get upgraded

- They become outdated

- They get replaced by something better

- In fact, without regulations, people can even launch meme coins, as Trump meme coin was launched

Just like MySpace was replaced by Facebook.

Just like Nokia was replaced by Apple.

Just like Orkut was replaced by Instagram.

Bitcoin can be replaced by another digital asset or a new technology.

But Gold? Gold cannot be replaced. Nothing humans create can easily duplicate it. We cannot make more gold in factories. We cannot create “Gold 2.0” in a startup pitch meeting.

Gold is divine. Bitcoin is man-made. And that difference shows in their stability, scarcity, and trustworthiness.

Conclusion

When you honestly look at Bitcoin vs Gold, one protects wealth while the other remains speculative. Bitcoin has innovation, hype, and the excitement of a new digital world. Gold has history, stability, and universal acceptance. When investors compare Bitcoin vs Gold, history, stability, and real-world demand clearly favor gold.

Gold is far more solid, stable, and grounded than Bitcoin.

Gold:

- Has intrinsic value

- Cannot be replaced or replicated

- Has thousands of years of proven trust

- Is backed by governments

- Comes from nature itself

Bitcoin:

- Has no real-world use

- Can be copied endlessly

- Has a short, volatile history

- Is not trusted by governments

- Is ultimately a human-made experiment

In a world full of uncertainties, digital bubbles, and financial hype, gold remains what it has always been: A timeless store of value that doesn’t need a blockchain, doesn’t need electricity, and doesn’t need belief — it simply is.

If stability matters, gold wins — clearly.